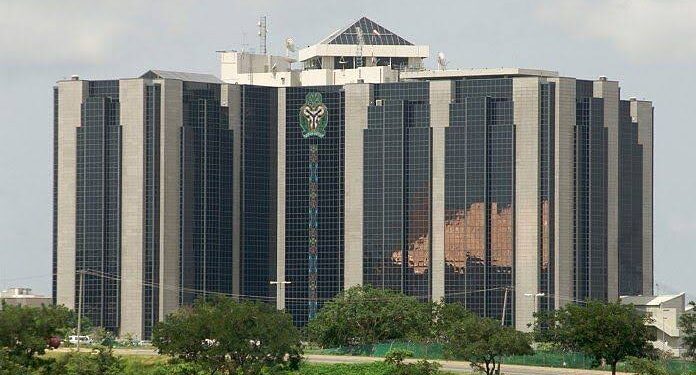

The Central Bank of Nigeria, CBN, has directed four fintech companies to stop onboarding new customers until further notice was given.

The affected fintechs businesses include: OPay, Palmpay, Kuda Bank, and Moniepoint and they were purportedly linked to allegations of accounts being used for illegal foreign exchange transactions.

Representatives from two affected firms had confirmed the development to newsmen on Monday, April 30.

An anonymous source from one of the fintech banks had this to say about the restriction:

“I can that confirm that 90% of the accounts compromised in the illicit forex transactions are from commercial banks, and only 10% cent are with fintechs.

“Why then has the CBN not extended this directive to the commercial banks? We [fintechs] face a widespread issue here, and targeting fintechs seems like an unfair focus on the more vulnerable targets.”

As at press time, none of the four businesses have reacted to the development.

This latest directive is coming amid a clamp down on currency speculators in the Nigerian foreign exchange market.

Only recently, the Court granted the Economic Financial Crimes Commission’s —EFCC request to freeze 1,146 bank accounts.