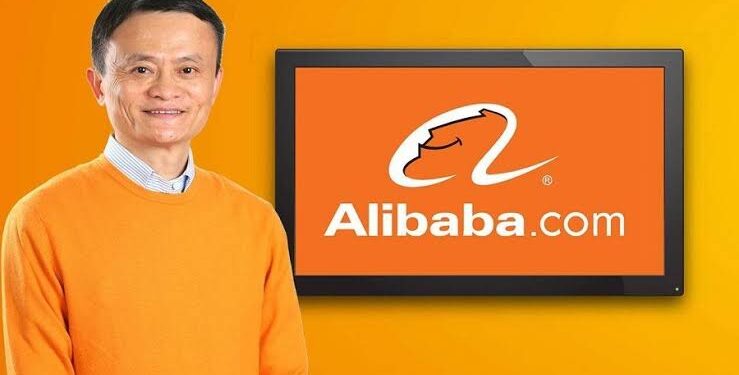

Alibaba Group Holding Ltd., the biggest online shopping company in China, has agreed to pay $433.5 million to settle a lawsuit filed by U.S. investors in 2020.

The investors claimed that Alibaba was using unfair practices, giving false information, and acting in ways that hurt competition, which made the company’s stock price seem higher than it should have been.

The plaintiffs, representing investors who held Alibaba’s American depositary shares between November 13, 2019, and December 23, 2020, said they lost a lot of money when Alibaba’s stock price went down. The allegations included:

- – Breaking laws against monopolies and unfair competition

- – Giving false information that made the stock price seem higher

- – Engaging in anti-competitive practices that hurt investors

Alibaba said it didn’t do anything wrong, but decided to settle the case to avoid spending more money on a long legal fight. The settlement still needs to be approved by a U.S. judge named George Daniels, who works in Manhattan.

Alibaba denied any wrongdoing but decided to settle to avoid long and costly legal battles and disruptions. The settlement proposal, submitted in a federal court in Manhattan, needs approval from U.S. District Judge George Daniels.

Key figures:

- – The most they could have paid: $11.63 billion

- – How much investors lost: Over $10 billion

- – How much they will pay: $433.5 million

This settlement comes after other big cases, like Jeffrey Epstein’s victims getting $290 million from JPMorgan and Nike settling over Lil Nas X’s ‘Satan Shoes.’ The Alibaba settlement is waiting for approval, which will help the investors who lost money.