In order to facilitate the issuance of National Identification Numbers to foreign nationals residing in the nation, the Federal Executive Council is recommending amending the National Identity Management Commission Act No. 23, 2007.

In an effort to allow for the taxation of foreign nationals residing and employed in Nigeria, the FEC also introduced the Economy Stabilisation Bill on Wednesday.

The purpose of the two proposed laws is to make provisions for the mandatory use of National Identification Number for transactions which are relevant for tax administration, and for related matters, and expand the scope of registrable persons to include foreign individuals with the taxable presence or taxable source of income in Nigeria.

The government recommends adding a new paragraph to Section 16 that states, “Any person, whether or not a citizen of Nigeria, who is deemed to be resident or otherwise subject to tax in Nigeria under any legislation in force in Nigeria.”

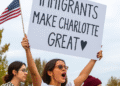

If the new plan becomes law, immigrants who earn an income and expatriates would both be subject to taxes.

This was disclosed during a briefing by Mr. Bayo Onanuga, the Special Advisor to the President on Information and Strategy, to State House Correspondents on Wednesday at the Aso Rock Villa in Abuja.

Onanuga added that if the National Assembly passes the measure, everyone living in Nigeria, including foreigners, will be registered and issued a NIN.

“Once you start working here and making money, you’ll be registered and given a NIN so you can be taxed.

“Your NIN will provide you with your tax identification, and you will be subject to our tax structure. The law that established the NIMC initially prohibits foreigners from registering.

” The presidential assistant revealed the third bill, which seeks to alter the Nigerian Maritime Administration and Safety Agency Act No.17, 2007, to “provide for the payment of fees and other charges in naira to improve the ease of doing business and for related matters.”

A new subsection (2), “All fees, charges, levies, fines and other monies accruing and payable to the Agency under this Act may be paid in Naira at the applicable official exchange rate, is added to Section 15, amending it.

“These agencies were charging in dollars before, but now they can always collect it in Naira,” Onanuga clarified.

Rather than having our entire economy denominated in US dollars, this government would like to place a strong focus on our own currency. “Pay in Naira,” the government is now stating. Not everything has to be expressed in US dollars.

Bottom Line

The proposal to amend the National Identity Management Commission Act to include foreign nationals will broaden the database of individuals in Nigeria.

This move aligns with global trends where countries seek to formalize the identities of all residents, regardless of citizenship, for economic, security, and administrative reasons. For Nigeria, this could enhance the tracking of foreign residents, streamline immigration data, and improve tax compliance.

However, enforcing NIN registration for foreign nationals may pose practical challenges. Foreign nationals, especially temporary workers or business people, might find this additional bureaucracy burdensome. The government would need to ensure that the NIN registration process is efficient and easily accessible.

By linking NIN with tax identification, the government can more easily track earnings and enforce tax obligations.

This is a pragmatic step toward building a more equitable tax system, where all residents contributing economically are also contributing to public coffers.