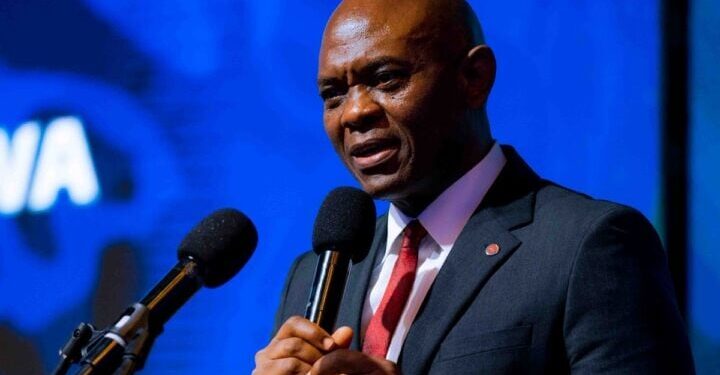

Tony Elumelu, the Chairman of United Bank for Africa, has said that Nigeria’s foreign exchange market is now “totally sorted.” Speaking after a meeting with President Bola Tinubu at the Presidential Villa in Abuja, Elumelu praised the Central Bank of Nigeria and the Tinubu administration for creating predictability and stability in the economy. But for many Nigerians, the question remains: can they really believe that the FX crisis, which affected businesses and households for years, is truly over?

The claims come amid a period of uncertainty, where ordinary citizens are still grappling with access to dollars for imports, paying for essential goods, and managing businesses dependent on foreign exchange. While Elumelu’s assurances signal confidence from one of the country’s most prominent financiers, the reality on the ground may not feel as resolved to everyday Nigerians.

A Market Transformed, or Just the Numbers?

Elumelu illustrated the shift in the FX market with a simple example. He said that before, if he received ten calls about banking issues, seven would be about how to access foreign exchange. Today, not even one call is about FX. “That market is totally sorted,” he asserted.

This, he claims, is the result of reforms under CBN Governor Olayemi Cardoso, including the unification of multiple exchange rate windows, the willing-buyer-willing-seller model, clearing a $7 billion verified backlog, and the introduction of the Electronic Foreign Exchange Matching System in 2024. Nigeria’s external reserves have also risen to over $43 billion in 2025, up from around $33.6 billion in 2023.

Yet, while statistics and numbers suggest stability, many businesses still report challenges. Small importers, traders, and manufacturers say delays in FX allocations remain common, and informal markets often operate at rates far above the official windows. This raises the question: is the FX market really “sorted,” or is it a success story visible only in official figures?

Power Sector Woes Cast a Shadow

Elumelu also emphasized the link between foreign exchange stability and other sectors of the economy, particularly power. He highlighted that payments owed by the Federal Government to power-generating companies have slowed growth and limited the electricity supply.

“Improvement in access to electricity is critical for economic development,” he said, calling on the government to fast-track payments. His Transcorp Group, which operates the Ughelli and Afam power plants, and holds a stake in the Abuja Electricity Distribution Company, is owed over N600 billion for electricity supplied to the grid.

Even if the FX market is functioning better, other structural problems, like unpaid debts in critical sectors, can undermine the overall economic picture. Stability in one area cannot fully offset instability elsewhere.

SMEs and the Future of Growth

Another focus of Elumelu’s discussion with President Tinubu was support for small and medium-scale enterprises (SMEs). Tax reforms, Bank of Industry programs, and other initiatives aim to empower entrepreneurs. While these programs are promising, their success depends on consistent policy implementation and availability of finance, which is closely tied to FX access.

For many SMEs, a lack of affordable dollars can still hinder importing raw materials, paying foreign suppliers, or maintaining operations. Even if the official market appears stabilized, challenges for small businesses remain pressing.

Public Perception and Trust

The question that Nigerians are asking is not only about numbers but also about trust. Elumelu’s confidence may reassure investors, but everyday citizens who suffered through years of FX scarcity may be more skeptical. Past promises of market stability often failed to materialize for small business owners and consumers, and rebuilding confidence takes more than statistics; it requires visible, tangible change.

Is the FX Crisis Truly Over?

On one hand, reforms, rising reserves, and official stability suggest significant progress. On the other hand, structural issues, unpaid debts, and ongoing complaints from businesses signal that challenges remain.

For ordinary Nigerians, the FX crisis is not just a financial issue; it affects daily life, business operations, and long-term economic confidence. While the CBN and government may have made strides, proving that the market is truly “sorted” will require more than statements from financiers.