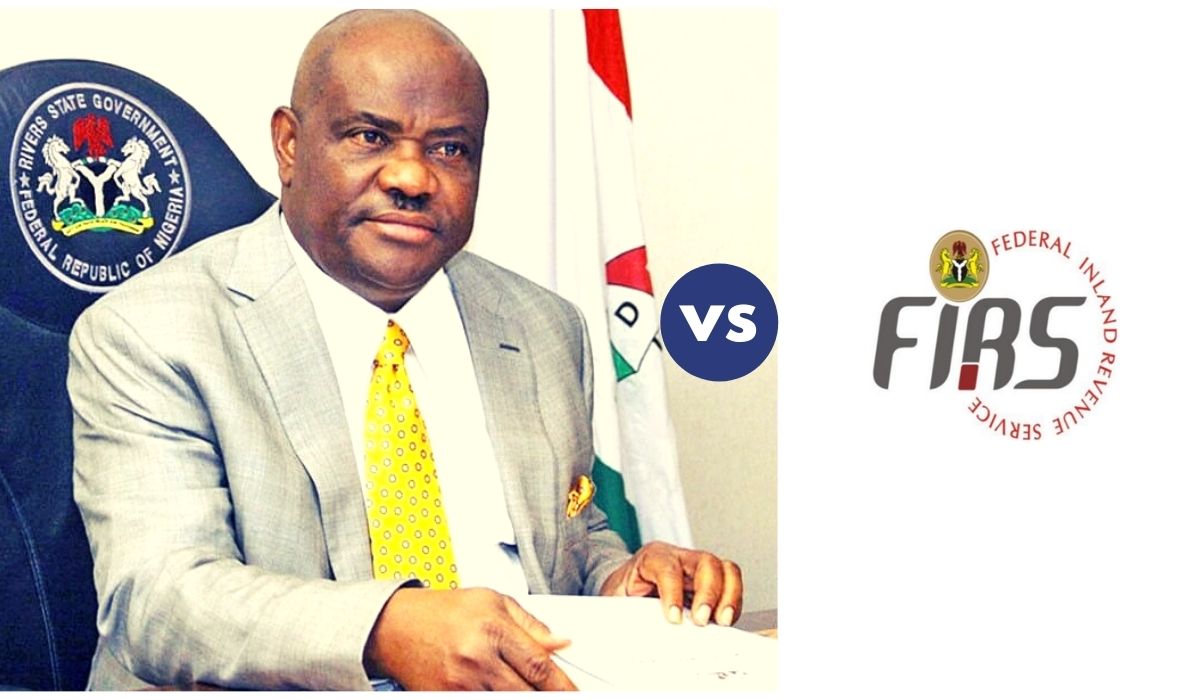

The Value Added Tax (VAT) imbroglio between Rivers State government and Federal government about whose prerogative to collect VAT, the legal tussle which federal high court sitting at Port Harcourt some months ago declared in favour of Rivers State. Before the judgement, the power of the administration of VAT was vested in FIRS that acts as a federal tax agency by the section 7 of the VAT acts.

The arrangement due to the uneven distribution of the VAT proceed among the states has pitched regions against one another calling themselves all sort of unprintable names, which also created a rancourous and mutual suspicion among the major ethnics in the country.

I have tried to restrain myself from writing or commenting my opinion on the VAT brouhaha, and as I have debated with people that the hullabaloo in itself is not about the economic emancipation of state, but an opportunity for some people to point accusing fingers to certain people as the reason why the country is not progressing both economically and infrastructurally.

The discussion can be hinged on two pedestal of collection which I will termed economic and distribution which I will also termed political, writing this now has only confirmed my decision to refrain from commenting on the issue as it is reeks more of political than economic. The furore it has generated create stingy emotional outbursts that’s devoid of logical submissions. Emotional in the sense that it throws blanket collection of VAT by the state government without recourse to how it is going to affect the ordinary citizens.

For clarity, what is VAT? VAT can be described to be a tax on spending or consumption levied at every stage of transaction, but eventually paid by the final consumer of such good and services. VAT is charged on most goods and services provided in Nigeria, and also on goods imported into Nigeria. VAT is currently calculated at a flat rate of 7.5% of the cost of services and products, and is charged on a wide array of goods and services.

The truth is that states can only conveniently collect VAT on intrastate transactions which some people presume form the largest chunk of the total VAT acruable to Nigeria. However, there are other components of VAT that includes interstate and international transactions which solely fall under the purview of central government which the agitators of state collection of VAT are not considering in the argument.

Now to the matter arising, it seems the issue is now subtly filtering out of popular discussion in the public sphere. As usual, with all other issues of our common interest which are solely based on emotions rather than logics, because it has no legs to stand upon. They have heavily argued that the states of the northern part of the country collect more of VAT than their southern counterparts. In recent data released by National Bureau of Statistics (NBS) about VAT generation and distribution has shown otherwise that there are also some states in the south that cumulatively receive more from VAT than what they generated to VAT. They have erroneously attributed low VAT generation in the north to the ban on the sales of alcohol in most states of the north, which only goes to confirm my worst fear that the agitation is political.

From the stats released by NBS, Kaduna’s N19.8bn is higher than the combined contribution of Abia, Cross River, Osun, Ekiti, Ondo and Imo. But before the release of the above data, guess who makes the loudest noise? Your guess is as good as mine.

The stats are out now; everywhere is silent! Where are the so called financial analyst? Those who believe the whole issue of VAT collection revolves solely around alcoholic drinks?

Why is the street silent about the latest news on VAT? Because Kano collected more than the whole south east states combined? Or Kaduna did better than almost all the oil producing states? Or because places like Abia got 10 times more than it generated? All this questions are pun intended.

Though Nigeria is in urgent need for restructuring, but not at the expense of playing politics with life of ordinary citizens who are ignorant of intentions of the ruling elites, which have been made to maintain that the economic which is the collection aspects of the VAT can stand, however, the distribution which is political ought to be adjusted instead of the outright cancellation. The ideal ways forward is for every party involved to dispassionately work towards the disentanglement of VAT collection. It is pertinent to know how much VAT accrues from the three components of VAT namely: intrastate, interstate and international transactions. This is achievable by simply publishing the breakdowns of proceed from the above stated VAT components.