Many African countries attending the China-Africa Forum this week hoped for a debt relief plan from China. However, to their disappointment, China did not provide the expected relief. Instead, it pledged 360 billion yuan ($50.7 billion) in credit lines and investments over the next three years.

Role of the Forum for China-Africa Cooperation (FOCAC)

The Forum for China-Africa Cooperation (FOCAC), launched in 2000, gained increased prominence after President Xi Jinping introduced the Belt and Road Initiative (BRI) in 2013. The BRI aims to recreate ancient trade routes for the world’s second-largest economy, while positioning China as the biggest bilateral lender to Africa.

FOCAC has helped China strengthen its relations with African nations and expand both diplomatic and economic ties across the continent. It also serves as a counterbalance to competition from other global powers like the United States, the European Union, and Japan. Hasnain Malik from Tellimer remarked that “China is moving back onto the front foot in terms of overseas capital deployment in emerging markets,” though investments haven’t yet returned to pre-COVID levels.

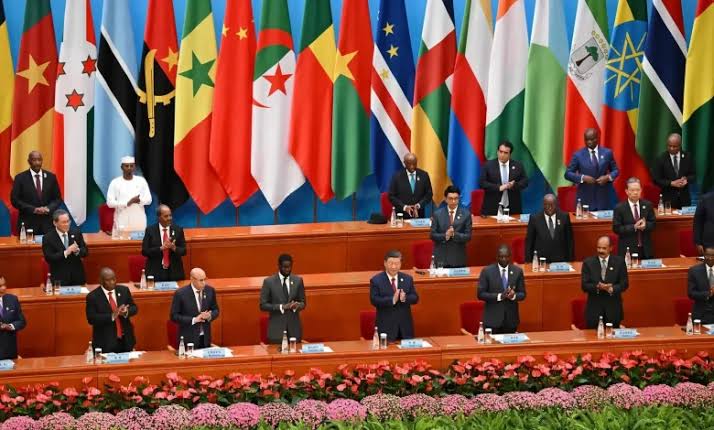

In Beijing, leaders from over 50 African countries gathered for discussions and a group photo with Chinese officials, led by President Xi Jinping, at the Great Hall of the People in Tiananmen Square.

China’s Financial Commitments to Africa

At the Forum, China announced a new financial pledge to Africa, larger than its 2021 commitment but still falling short of the $60 billion committed in 2015 and 2018. These earlier peak years saw heavy funding for infrastructure projects like roads, railways, and bridges. However, since 2019, a decline in funding has left many of these projects unfinished.

The newly pledged funds will be directed toward 30 infrastructure projects aimed at improving trade links across Africa, though China did not provide specific details about the projects.

Africa’s Infrastructure Needs

Africa, with its 54 countries and over 1 billion people, faces an annual infrastructure funding gap of $100 billion. The continent urgently needs better transportation and trade networks to support the African Continental Free Trade Area (AfCFTA), a major trade bloc initiative. China has been a key player in financing infrastructure projects in Africa, which has improved connectivity in various regions.

However, China’s focus in recent years has shifted to smaller, less costly projects due to its own domestic economic challenges and concerns over the growing debt risks in African countries. This shift has left Africa struggling with the challenge of filling its massive infrastructure gap.

The Impact of China’s Funding in Africa

China’s investments have had significant impacts on Africa. Chinese-funded infrastructure projects have improved roads, railways, and ports, facilitating trade and economic growth in many African nations. These projects have enhanced transportation networks, enabling better movement of goods and people across borders. Additionally, China has supported the development of energy and telecommunications infrastructure, bringing power and internet access to underserved areas.

However, the rapid increase in Chinese loans has also contributed to growing debt in some African countries, leading to concerns about long-term sustainability. Critics argue that the reliance on Chinese loans may place some nations at risk of debt distress, with potential implications for their economic stability. On the other hand, supporters of Chinese financing argue that without these loans, many African countries would struggle to fund essential infrastructure projects that drive economic development.

China’s Lending Strategy

When asked how these new commitments fit into China’s more cautious overseas lending strategy, Foreign Ministry spokesperson Mao Ning explained that the cooperation between China and African countries is based on mutual discussions and agreements. China continues to support projects that align with both sides’ interests, though with a more measured approach to avoid excessive debt risks.