Russia’s economy is in a difficult position, facing a potential “massive credit crunch” due to a rapid sell-off in bonds. The Russian government recently had to cancel a £5 billion bond sale because there were not enough buyers. This lack of interest from banks and private investors shows that they are cautious about taking on more debt without getting higher returns, which could make it much more expensive for the government to borrow money.

Russia’s government bond index has dropped to its lowest point since Western countries imposed sanctions after the invasion of Ukraine in 2022. Construction companies like Samolet, Brusnika, and Strana Development have seen their bonds lose 4-5% of their value, with returns rising to 34-37%.

The country’s spending on defense has more than doubled since 2021, reaching £93 billion in 2024. This increase has caused Russia’s budget to be out of balance, with a projected deficit of 1.1% of GDP this year, compared to a 0.4% surplus in 2021.

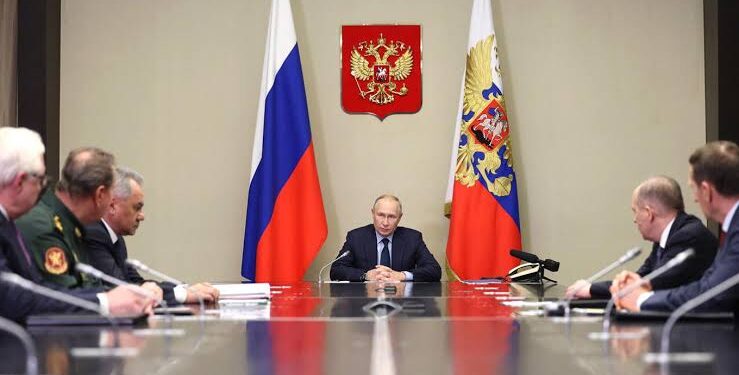

Experts warn that President Putin faces a tough economic dilemma. Alexander Mertens, a finance professor, points out that either continuing the war for a long time or trying to end it could lead Russia into a big economic problem.

To make matters worse, Russia is having trouble getting enough food, especially butter, which has become 23% more expensive since January. The government is now bringing in butter from Turkey and the United Arab Emirates and asking to bring in 30,000 tonnes without paying extra fees.