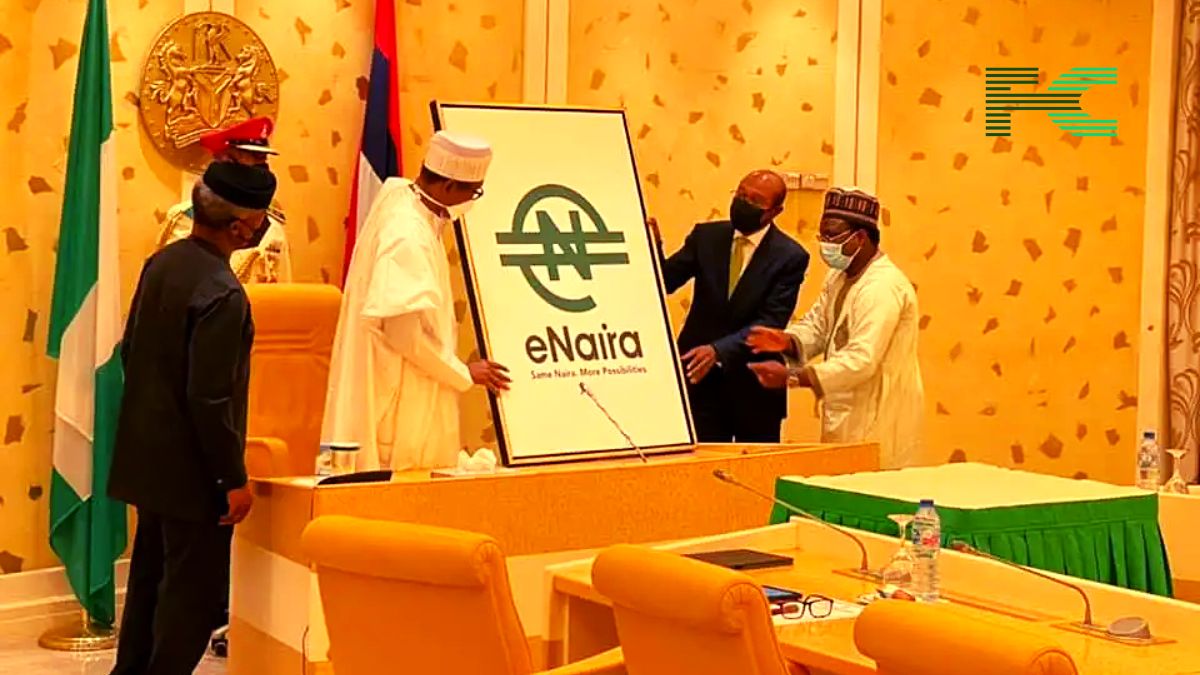

The Central Bank of Nigeria -CBN, has recommended a reward scheme for Nigerian users of the e-Naira, including merchants.

This means that merchants with the required promotional materials, subsidizing the latest Merchant Service Charge by 50%, and activation of a nationwide sensitization that early business adopters of e-Naira can leverage on the market for wider adoption.

The reward scheme had been given the green flag by the CBN Deputy Governor, Economic Policies, Kingsley Obiora, this weekend at the e-Naira merchants’ mega event in Abuja, organized by the CBN, in partnership with Araba Technologies LTD, PNAIL, and Abuja Chambers of Commerce and Industry -ACCI, for Nigerian business community.

It has also been confirmed that the e-Naira platform is able to facilitate payments using QR Codes, USSD, Wallet ID, and e-Naira Wallet tag. The value-added services on the platform are branch/sub wallets, employee management, and interoperability with other enterprise applications.

“Other innovative services on the e-Naira platform will be gradually rolled out by the CBN in collaboration with financial institutions and Fintech that are already leveraging on the e-Naira technology.” Obiora had concluded.

The Central Bank of Nigeria -CBN, has recommended a reward scheme for Nigerian users of the e-Naira, including merchants.

This means that merchants with the required promotional materials, subsidizing the latest Merchant Service Charge by 50%, and activation of a nationwide sensitization that early business adopters of e-Naira can leverage on the market for wider adoption.

The reward scheme had been given the green flag by the CBN Deputy Governor, Economic Policies, Kingsley Obiora, this weekend at the e-Naira merchants’ mega event in Abuja, organized by the CBN, in partnership with Araba Technologies LTD, PNAIL, and Abuja Chambers of Commerce and Industry -ACCI, for Nigerian business community.

It has also been confirmed that the e-Naira platform is able to facilitate payments using QR Codes, USSD, Wallet ID, and e-Naira Wallet tag. The value-added services on the platform are branch/sub wallets, employee management, and interoperability with other enterprise applications.

“Other innovative services on the e-Naira platform will be gradually rolled out by the CBN in collaboration with financial institutions and Fintech that are already leveraging on the e-Naira technology.” Obiora had concluded.